What is J.P. Morgan's Secretive GPT?

LLMs trained on proprietary data is going to be a big deal.

Hey Everyone,

In late February, 2023 JPMorgan Chase restricted its staff's use of OpenAI's ChatGPT chatbot. Three months is a long time to come to such a decision, butter late than never I suppose.

In 2023 more companies are training LLMs on their proprietary data and will use it to improve productivity and augment customer facing products.

Recently a few months later, it’s come out that JPMorgan Chase is developing a ChatGPT-like software service that leans on a disruptive form of artificial intelligence to select investments for customers.

IndexGPT Trademark

Fin-Tech and Banks need to become tech companies to keep up, and they are doing just that. Financial giant JPMorgan Chase has filed a trademark application for a finance-themed chatbot called IndexGPT.

JPMorgan states that it is hiring around 2,000 data managers, data scientists, and machine learning engineers to enhance its AI capabilities.

Goldman Sachs and Morgan Stanley banks have already started testing AI for internal use.

While tech companies are conducting layoffs, freezing salaries and cutting benefits, big banks are racing to catch up in their A.I.

Back in late March, 2023 Bloomberg revealed their BloombergGPT. If A.I. is going to transform Finance it will be very interesting to see what these major banks and FinTech leaders do with their data.

This includes the future of investing, trading and how A.I. will impact the market itself.

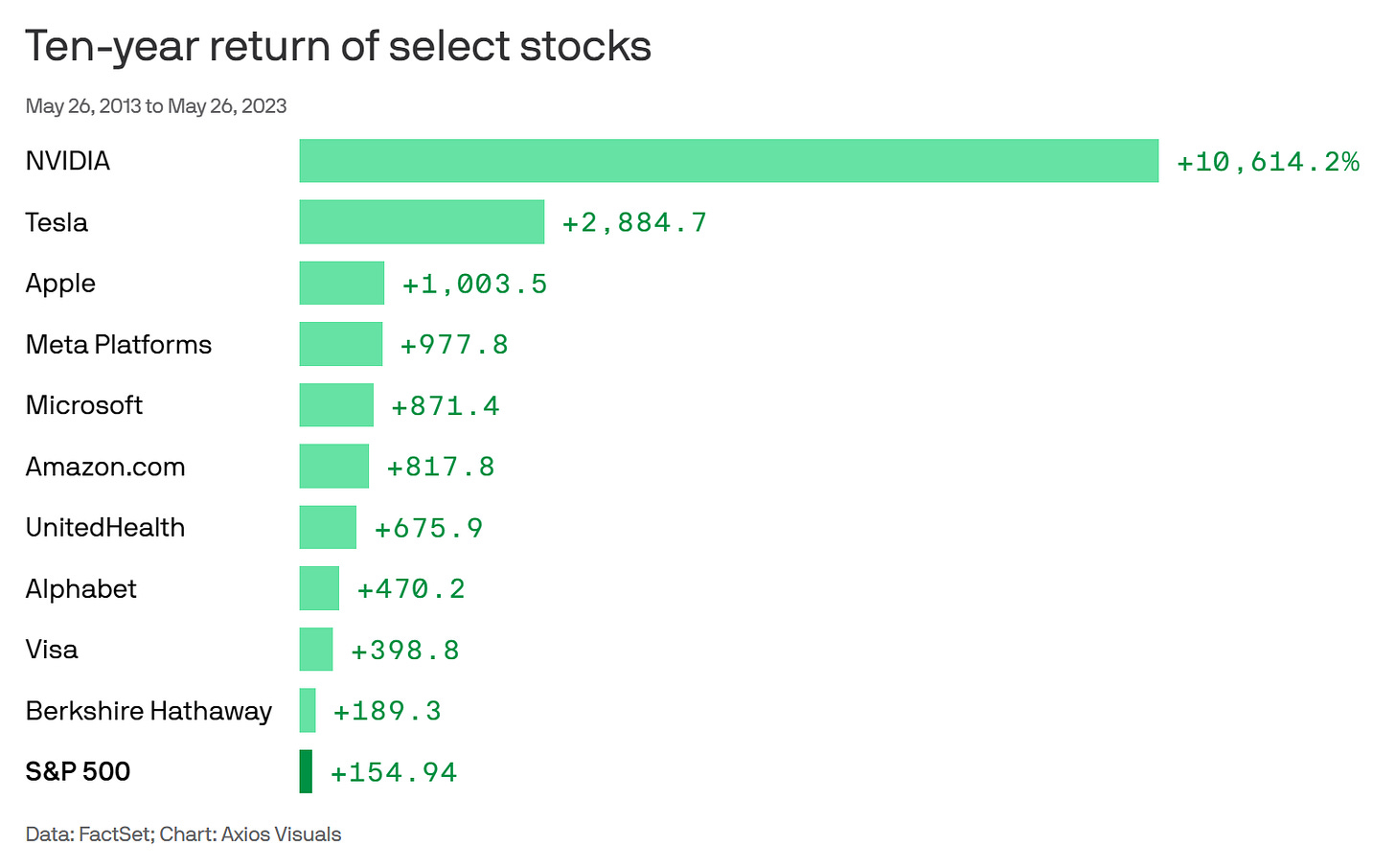

Is A.I. the new dot come era bubble? Axios had reported an interesting graph that I found curious:

So what is this IndexGPT about?

“It’s an A.I. program to select financial securities,” said trademark lawyer Josh Gerben. “This sounds to me like they’re trying to put my financial advisor out of business.”

Large language models are going to crunch a lot of data and help us make better choices in the market.

According to the trademark filing, IndexGPT, similar to ChatGPT in functionality will essentially be a “cloud computing software using artificial intelligence.” It will be used for “analysing and selecting securities tailored to customer needs.”

Read about the filing here. According to the application submitted on May 11 to the United States Patent and Trademark Office, the chatbot would be used for advertising and marketing services, an index of securities prices, online financial information, and investment counseling.

A SaaS featuring GPT models in the field of financial services.

Banking is trying to pivot in the era of Generative A.I. That includes ways to help Goldman engineers create code (CNBC) or answer Morgan Stanley financial advisors’ queries.

If anyone can keep up with BigTech in the banking sector, it’s likely to be JP Morgan Chase.

"AI and the raw material that feeds it, data, will be critical to our company’s future success," JPMorgan Chase CEO Jamie Dimon said in a letter to shareholders in April. "The importance of implementing new technologies simply cannot be overstated."

If Generative A.I. is seen as a gold-rush by some, how powerful corporations pivot to keep up is really going to be part of the story to watch.

First mover?

But JPMorgan may be the first financial incumbent aiming to release a GPT-like product directly to its customers, according to Washington D.C.-based trademark attorney Josh Gerben. (Read his Newsletter).

“This is a real indication they might have a potential product to launch in the near future,” Gerben said.

According to CNBC, while it is unclear exactly which AI does the bank plan to use for the service, the filing reveals that it will use AI powered by “Generative Pre-trained Transformer (GPT) models.”

“Companies like JPMorgan don’t just file trademarks for the fun of it,” Josh Gerben, a Washington D.C.-based trademark attorney told the news website. The filing reads a “a sworn statement from a corporate officer essentially saying, ‘Yes, we plan on using this trademark.’”

Anyone involved in the stock market and A.I. could have seen this a mile away, but that time is coming. A time when our personal assistant will be in a better position to handle our portfolio than an expert or ourselves or even those safe index funds.

While trademarks take nearly a year to approve, Gerben informed that the bank should ideally develop the AI service within three years of approval to secure the trademark.

IndexGPT could be off to the races by 2026 or 2027. The question is in the context of Generative A.I, will that be fast or slow to market?

Thanks for reading!